Apply online for expert recommendations with real interest rates and payments. Because tenant improvements are specific to the tenant, and not the property as a whole, this cost also gets excluded from any NOI accounting. Below, we’ll walk through all the numbers to include in your formula and how to calculate NOI.

Heritage Global Inc. Reports Net Operating Income of $3.1 Million … – Business Wire

Heritage Global Inc. Reports Net Operating Income of $3.1 Million ….

Posted: Thu, 10 Aug 2023 07:00:00 GMT [source]

While a good operating income is often indicative of profitability, there may be cases when a company earns money from operations but must spend more on interest and taxes. This could be due to a one-time charge, poor financial decisions made by the company, or an increasing interest rate environment that impacts outstanding debts. Alternatively, a company may earn a great deal of interest income, which would not show up as operating income. It’s important to note that operating income is different than net income. Operating income includes expenses such as costs of goods sold and operating expenses.

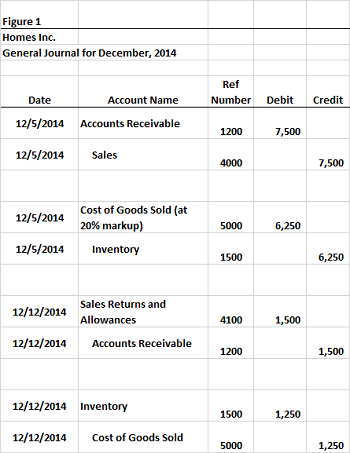

Operating net income formula: an example

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

Net operating income (NOI) is a calculation used to analyze the profitability of income-generating real estate investments. NOI equals all revenue from the property, minus all reasonably necessary operating expenses. Net income is the amount of profit a business has left over after it pays all its expenses over a specified period, such as a fiscal year or quarter. These expenses include the cost of producing goods, operating expenses, non-operating expenses and taxes—all of which are subtracted from a company’s total revenue to arrive at net income. However, it looks at a company’s profits from operations alone without accounting for income and expenses that aren’t related to the core activities of the business.

What Is Net Operating Income?

The difference between net operating income (NOI) and gross operating income (GOI) is how expenses affect the outcome. Also, you face the possibility of a tenant not paying rent due to their lost income. In this case, you may experience a net operating loss if your rental income is less than your expenses. NOI is just one quick method to assist investors making purchasing decisions, but there is more than one way to get started investing in real estate.

NOI is generally used to analyze the real estate market and a building’s ability to generate income. Real estate property can generate revenues from rent, parking fees, servicing, and maintenance fees. A property might have operating expenses of insurance, property management fees, utility expenses, property taxes, janitorial fees, snow removal and other outdoor maintenance costs, and supplies. Net operating income can be calculated in different ways, but the generally accepted method is gross rental income plus any other income minus vacancies minus operating expenses equals net operating income.

The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Gross vs. net income: What’s the difference?

Any lost income due to vacancies or unpaid rent is subtracted from gross potential income. NOI also measures the potential return on investment of a property based on its purchase price using what’s known as the capitalization rate or cap rate. For example, an apartment building purchased for $10 million that produces $1 million in annual net operating income has a cap rate of 10% (or $1 million divided by $10 million). Daily maintenance costs are included in the NOI calculation under operating expenses. However, major repair jobs and replacement of long-term assets are classified as capital expenditures and are excluded from the calculation. Debts, including mortgage payments, are not included in NOI calculations as the amount can vary widely from investor to investor.

However, this does not indicate an improvement to the property as a whole. Income tax is another figure that is specific to the investor or owner and should not be included when calculating NOI. In other words, NOI helps investors determine the property’s value, which helps them to compare various properties they may be interested in buying or selling. Join BiggerPockets and get access to real estate investing tips, market updates, and exclusive email content. A real estate investment trust (REIT) is a company that owns or finances real estate for an investor. Certain numbers are excluded from NOI calculations because they do not support the purpose of net operating income (NOI).

Financial statements come from solid books, so try a bookkeeping service like Bench. Investors and lenders sometimes prefer to look at operating net income rather than net income. This gives them a better idea of how profitable the company’s core business activities are. When your company has more revenues than expenses, you have a positive net income. If your total expenses are more than your revenues, you have a negative net income, also known as a net loss. The first part of the formula, revenue minus cost of goods sold, is also the formula for gross income.

Net income of a business

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. Since the capital structures, levels of competition and scale efficiencies are different from industry to industry, the operating margins can vary widely. If Wyatt wants to calculate his operating net income for the first quarter of 2021, he could simply add back the interest expense to his net income. If the property isn’t fully rented, you’re not sure what the rents should be, or the property needs to be rehabbed, there are alternative ways to analyze an investment property.

Basically, you should include all revenue streams coming from the income-producing property. The net operating income (NOI) and earnings before interest, taxes, depreciation, and amortization (EBITDA) are each non-GAAP financial measures, yet widely used in their respective industries. These costs are usually one-off expenses and can vary significantly depending on the region and nature of the purchase. Instead, they are typically covered using cash reserves and other savings. Any real estate investor should have a few essential tools in their toolbox.

D Trump footwear company earned total sales revenues of $25M for the second quarter of the current year. As a result, the income before taxes derived from operations gave a total amount of $9M in profits. NOI is a helpful mathematical formula real estate investors can use to calculate how profitable a potential investment property is in a single year, by taking into account annual expenses.

Net income is the result of all costs, including interest expense for outstanding debt, taxes, and any one-off items, such as the sale of an asset or division. Net income is important because it shows Net Operating Income a company’s profit for the period when taking into account all aspects of the business. Investors may often hear or read net income described as earnings, which are synonymous with each other.

Knowing the vacancy history of the rental property will make your calculations more accurate. Companies may be more interested in knowing their operating income instead of their net income as operating income only incorporates the costs of directly operating the company. Operating income can be calculated several different ways, but it is always found towards the bottom of a company’s income statement. Operating income is generally defined as the amount of money left over to pay for financial costs such as interest or taxes.

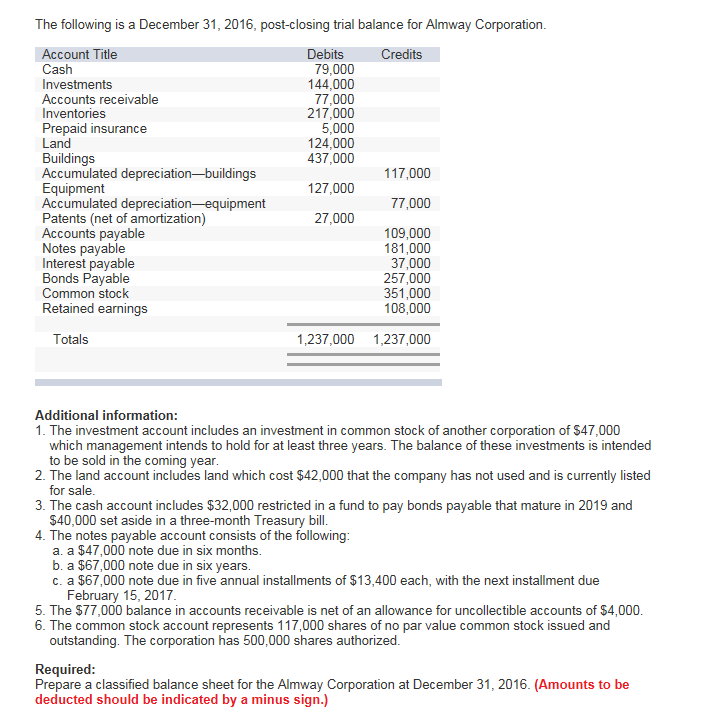

In this formula, you must have a fully calculated income statement as net income is the bottom and last component of the financial statements. In this case, the company may already be reporting operating income towards the bottom of the report. Its EBIT equation is $50 million (revenue) plus $1 million less $10 million (maintenance expenses), less $20 million (cost of goods sold), and less $3 million in depreciation, equalling $18 million. The bottom line is also referred to as net income on the income statement. Net income is also referred to as net profit, net earnings, net income after taxes (NIAT) and the bottom line—because it appears at the bottom of the income statement. A negative net income—when expenses exceed revenue—is called a net loss.

While it doesn’t give a complete picture of a property’s financials, NOI is a relatively simple formula that offers real insight into cash flow. It’s a figure that is difficult to manipulate and gives clues about how well a property is managed. As a result, it can be useful for predicting potential return on investment. Operating income and net income are both essential measures of business success.

- It’s profit that can be distributed to business owners or invested in business growth.

- Make sure you consider your specific needs before making real estate investment decisions.

- However, operating expenses aren’t just maintenance fees, but include expenses like insurance and professional help.

- Let’s take a look at an example of how to calculate net operating income on an investment property.

Bench assumes no liability for actions taken in reliance upon the information contained herein. This program breaks down everything you need to build and interpret real estate finance models. Used at the world’s leading real estate private equity firms and academic institutions. The resulting figure must be multiplied by 100 to express the margin as a percentage. By re-arranging the formula, the estimated property value can be derived. However, more important than what expenses factor into NOI are the expenses that do NOT impact NOI.

Therefore, you can use NOI and the cap rate to determine if rental properties are a sound investment and what your annual return will be. The advantage of using the NOI formula is that it’s a simple calculation to determine a property’s operating performance. Now that we can answer “What does NOI stand for?” and understand the meaning of the net operating income of real estate, let’s talk about how to find net operating income. Direct costs are expenses incurred and attributed to creating or purchasing a product or in offering services. Often regarded as the cost of goods sold or cost of sales, the expenses are specifically related to the cost of producing goods or services.

Operating income measures the cost of a business’s everyday operations, while net income measures the cost of operating a business plus any non-operating expenses, such as debts and investments. Operating an investment property can be expensive, and yes, there will be years where more capital is required for maintenance. However, because this expense can vary widely year-to-year and property-to-property, we do not include large one-time expenses in a NOI calculation. Depreciation isn’t an actual expense because you never “pay” for depreciation out of pocket like with a cash or check. Depreciation only becomes “real money” when writing it off on your taxes or during the sale of a potential property.

Leave a Reply