However, at the end of that period, the close price is still able to stay at the level of the open price. It suggests that buyers in the market are able to absorb this much selling and pull back the price. A dragonfly doji is considered a signal of a potential reversal in the security price.

Following an uptrend, it shows more selling is entering the market and a price decline could follow. In both cases, the candle following the dragonfly doji needs to confirm the direction. If the candlestick occurs right after the bullish dragonfly rises and closes at a higher price, the price reversal has been https://g-markets.net/ confirmed, and trading decisions can be made. A Doji, on the other hand, would indicate a price drop, also known as a bearish dragonfly, if the market had previously shown signs of strength. Doji’s with strong Bullish or Bearish implications, like the dragonfly doji, often make for good reversal candles.

In the meantime, we’d like to gift you our trading roadmap and its best 55 resources.

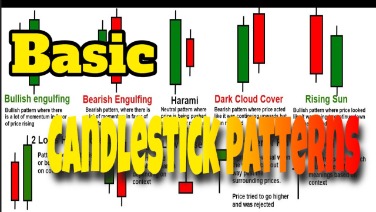

Price charts are one of the most valuable tools for technical analysis. They enable traders to analyze the market and spot potential trends before they develop. Candlestick charts also allow traders to identify candle patterns, such as Dojis.

How To Technically Analyze A Stock – Forbes

How To Technically Analyze A Stock.

Posted: Tue, 29 Aug 2023 07:00:00 GMT [source]

A doji candlestick forms when a security’s open and close are virtually equal for the given time period and generally signals a reversal pattern for technical analysts. Candlestick is a type of charting that contains the open, close, high, and low prices of an asset for a specific time period. Candlestick charts are more informative than typical line charts, which only provide the close price or average price. Thus, candlestick charts are more prevalently used in technical analysis than line charts. The Dragonfly Doji candlestick pattern is a very difficult one to trade which often leads many traders down the wrong path.

Understanding the Dragonfly Doji Candlestick

One example of a Doji candle is the Dragonfly Doji candlestick pattern. The gravestone has a long upper shadow and no lower one, while the long-legged doji has both upper and lower shadows of approximately equal length. The long lower shadow indicates that buyers entered the market, pushing the market up from its lows. This could be seen as a signal to consider going long or watching for a further bullish confirmation before taking action. Traders may place a stop loss below the bar with a take profit at the closest resistance level or may consider the risk/reward ratio. The dragonfly doji, like all the other candlestick patterns, should not be used in isolation.

A Dragonfly Doji signals that the price opened at the high of the session. Pending orders refer to those that direct a broker to buy or sell an asset at a certain price. In this case, you can place a buy-stop above the doji and a sell-stop below the lower shadow. There are several things to do to confirm a trend and prevent false signals.

How is the Dragonfly Doji pattern formed?

We also offer real-time stock alerts for those that want to follow our options trades. You have the option to trade stocks instead of going the options trading route if you wish. The Bullish Bears trade alerts include both day trade and swing trade alert signals. These are stocks that we post daily in our Discord for our community members.

- This means that the doji reversal candlestick pattern indicates the potential reversal of a price downtrend and the start of an uptrend.

- Our services include coaching with experienced swing traders, training clinics, and daily trading ideas.

- We realize that everyone was once a new trader and needs help along the way on their trading journey and that’s what we’re here for.

- First, a trader can place a buy-stop above the doji candle or place a sell-stop below its lower side.

- The Dragonfly Doji pattern is similar to the hammer and hanging man but has a few key differences.

To identify a Dragonfly Doji, look for a candlestick with a long lower shadow, little to no upper shadow, and a small body near the top of the price range. The absence of an upper shadow or a very small one confirms buyer strength, as prices were pushed up to the session’s high without encountering resistance. dragonfly doji candlestick The color of the Dragonfly Doji (green or red) provides further insight into market sentiment. Typically resembling a plus sign or a cross, this small signal (formed of just one candlestick and lacking a body) is still important. In fact, it has the power to change traders’ buying and selling strategies.

Gravestone Doji and Long-Legged Doji

Therefore, if you want a signal for a potential upside or downside reversal in price, Dragonfly Doji is a type of candlestick pattern you must be looking for. Doji patterns indicate a transition in prices or that the market is undecided about the direction prices will take. As a category, they are best described as a transitional pattern rather than a reversal or continuation pattern. Specific types of Doji patterns – like the Dragonfly or the Gravestone – can signal a possible reversal in prices but are best used in conjunction with other indicators. The dragonfly doji is not a common occurrence, therefore, it is not a reliable tool for spotting most price reversals.

- The dragonfly doji rarely occurs, but price reversal happens constantly.

- As mentioned above, the other two types of doji patterns are the gravestone doji and the long-legged doji.

- This indicates that buyers are now in control and that prices are likely to move higher from here.

- Following an uptrend, it shows more selling is entering the market and a price decline could follow.

- These doji candlestick patterns are bullish reversal signals and appear when a candlestick pattern’s opening, closing, and low price values are equal.

If a dragonfly doji is found during the early stages of a downtrend, it may just signify a short pause, or relief before the trend continues down. For a Dragonfly Doji to be a reversal candle, there should have been a preceding downtrend. Given the bullish implication of the dragonfly doji, it can only logically “reverse” an ongoing downtrend.

To trade the Dragonfly Doji candlestick pattern it’s not enough to simply find a candle with the same shape on your charts. Similarly, if it forms along with a bullish divergence on the RSI indicator, it could provide additional confirmation for a potential bullish reversal. We have a basic stock trading course, swing trading course, 2 day trading courses, 2 options courses, 2 candlesticks courses, and broker courses to help you get started.

The Dragonfly Doji trading strategy combines the power of candlestick patterns, trend analysis, momentum indicators, and support/resistance levels to identify potential trend reversals. The Dragonfly Doji pattern is similar to the hammer and hanging man but has a few key differences. The dragonfly doji has a long lower shadow, the short body on a candlestick chart that forms in bullish markets anticipating a bearish reversal.

As a bullish reversal pattern, the Dragonfly Doji is a great pattern to watch for when the price is on an uptrend. Dragonfly Doji indicate that there may be an imminent change in market sentiment or some sort of reversal from bullishness to bearishness happening soon. The Dragonfly Doji’s long lower shadow and minimal upper shadow indicate buyers successfully pushed prices back to the opening price despite initial selling pressure. Each day our team does live streaming where we focus on real-time group mentoring, coaching, and stock training. We teach day trading stocks, options or futures, as well as swing trading. Our live streams are a great way to learn in a real-world environment, without the pressure and noise of trying to do it all yourself or listening to “Talking Heads” on social media or tv.

Strategy 2: Trading The Dragonfly Doji With Support Levels

It’s important to remain patient and wait for a clear confirmation before making any trading decisions based on the dragonfly doji pattern. In summary, while both the Hammer and Dragonfly Doji patterns signal potential bullish reversals after a downtrend, they differ in their formation. The Hammer has a small body at the top, while the Dragonfly Doji has little to no body. Both patterns indicate an increase in buying pressure and require confirmation from subsequent bullish candlesticks to validate the trend reversal. While the dragonfly doji has a long lower shadow and little or non-existent upper one, the gravestone or inverted dragonfly doji has a long upper wick and little or non-existent lower one.

Leave a Reply